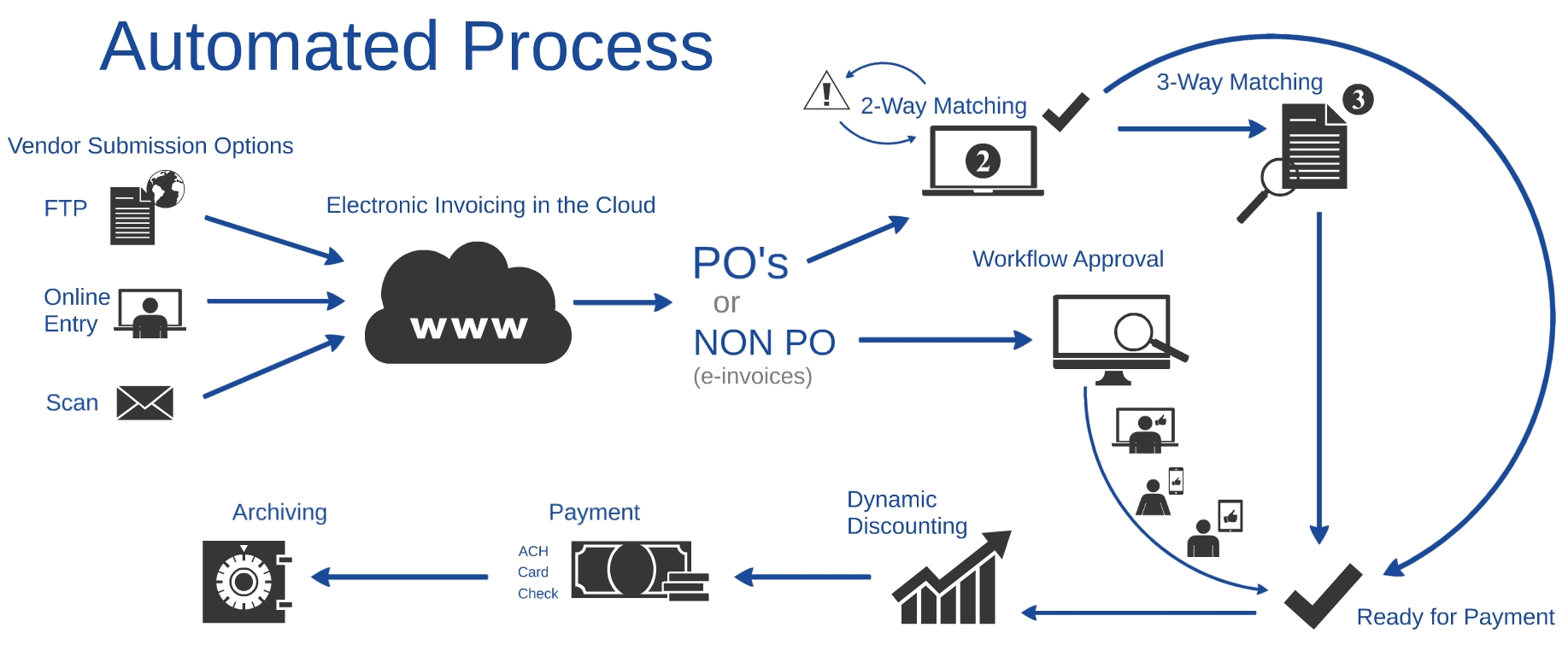

Manual system is not the way to because it is highly inefficient and lacks proper controls. There are two ways to process accounts payable, manual and automated.

Make sure that all transactions are payable.Setting up an accounts payable process is one of the most valuable things you can do for your business. Whether you are a small business, startup, or even a corporation, every company has to deal with accounts payable. Follow-up with slow-paying vendors or those who haven't responded to requests for additional information about invoice amounts.Post payments to the accounting system regularly.Create payments when invoices are received from suppliers.Enter purchase orders into the system and send out purchase orders.Establish credit limits for each vendor.Establish different payment terms with vendors.Identify suppliers and create vendor master file.

The summary below shows a basic breakdown of the AP process:. There are different ways to set up your AP process however the critical components of the AP process remain the same. But many small businesses today are wise to outsource their accounts payable functions because it is often a manual process.Īs per a recent survey by PYMNTS, 86% of finance professionals view automation as a new revenue generation process to boost customer satisfaction. The job of this department is to deal with invoices, orders, and checks associated with purchases. In short, they record your business's financial obligations or liabilities to others. Let’s get right into it:- Accounts payable cycle-an overviewĪccounts Payable are the financial records of a business that detail the transactions associated with the buying and selling of products, services, and other resources. We take this opportunity to discuss different aspects of AP automation and help you choose the best-suited AP automation tool for your business. It helps unify your entire organization around key metrics by automating processes and eliminating manual tasks, so everyone can focus on the things that matter - growing revenue and managing costs. Automating Accounts Payable reduces the time it takes to receive, process, and pay invoices and helps drive business intelligence by bringing together information from various sources.

0 kommentar(er)

0 kommentar(er)